A bit contrary to the old saw that diversification is your friend, just a handful of stocks generated the bulk of the market’s historically generous performance for the year to date. These enormous, mostly Technology-oriented companies also dominated market conversation in 2023. A good bit less covered are other distinctions of this year’s market momentum:

- Even with the notable moves at the top of the capitalization spectrum, the concentration overshadowed a not-so-terrible year for a good number of other stocks

- But gains were concentrated across more expensive “Growth” stocks as investors were glamoured by a range of the more exciting stories they presented

- But as investors bid up the shares of Growth stocks by bringing the expected gains of those longer-term fundamental growth stories forward, they’ve (theoretically, at least) reduced the upside potential in the shares

- And if history is any guide, investors may have left themselves open to disappointment if realized growth does not achieve the lofty goals they’ve now established

Top-Side Lopside

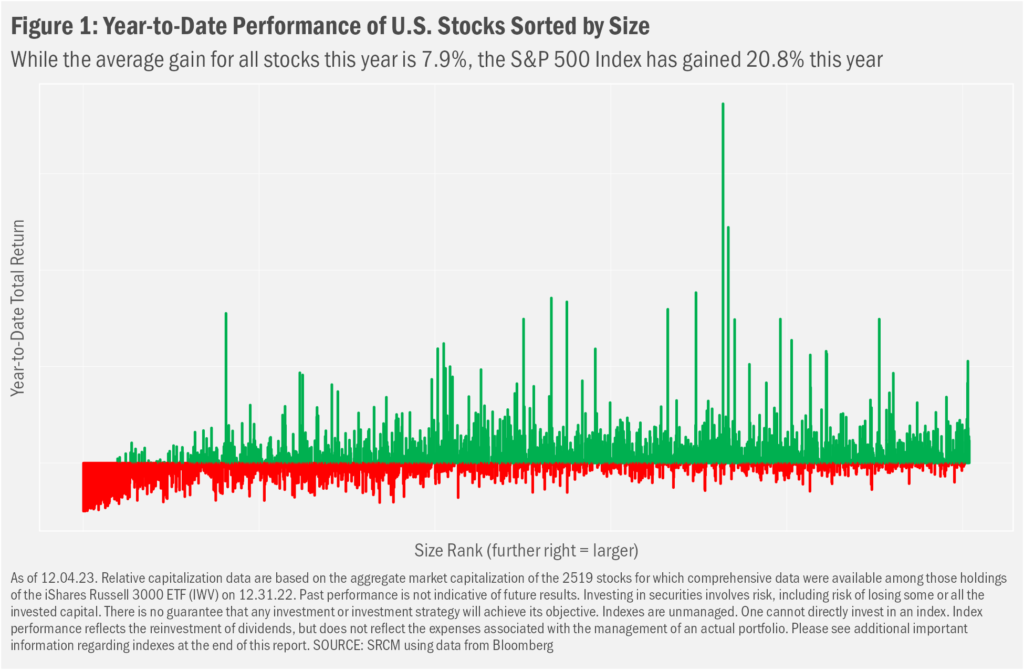

Despite the rather gloomy prognoses making rounds earlier in 2023, the U.S. stock market is strongly in the green for the year. It’s been quite the story of the haves and the have-nots, though: just a bit more than half of the 2,519 stocks that we reviewed this month are up on the year. And while the S&P 500 Index, an index commonly referenced as “the market” for its relatively wide representation and long history (despite this moniker not being entirely factual, given the lack of smaller-stock representation), is up more than 20% in 2023, the average stock across all capitalizations has gained just under 8%. How can it be that the market gain is so much different—so much better than—that of the average stock? The discrepancy arises from the fact that the S&P 500, like most broad-market equity indexes, is capitalization weighted, meaning the larger the stock, the more impactful is its individual contribution to the overall market’s return. As we show in Figure 1, turns out that a fair number of stronger-performing stocks can be found among the larger-cap names in the universe, meaning their outsized gains have had outsized influence on the overall charge higher.

Higher Price for Growth

It’s not abnormal for a handful of stocks to see stellar gains in any particular year. So far, 11% of stocks have gained more than 50%, while close to 3% of stocks have more than doubled. But it is rather abnormal for a group of the largest stocks to garner as much attention as a select few have this year, as a group of technology-industry and tech-adjacent companies have dominated domestic market returns by virtue of their enormous sizes and their top-of-chart year-to-date gains. This septet comprises Alphabet (GOOG / GOOGL, up 47.2% YTD), Amazon (AMZN, 72.4%), Apple (AAPL, 46.6%), Facebook (META, 165.9%), Microsoft (MSFT, 55.3%), Nvidia (NVDA, 211.5%) and Tesla (TSLA, 91.2%), dubbed “The Magnificent 7” by a Wall Street investment strategist. Not sure why, exactly, the analyst chose that name, or why it seems to have stuck, but their magnificence has come minimally from their otherwise remarkable propensity to absorb so much of the flow into the U.S. stock market this year.

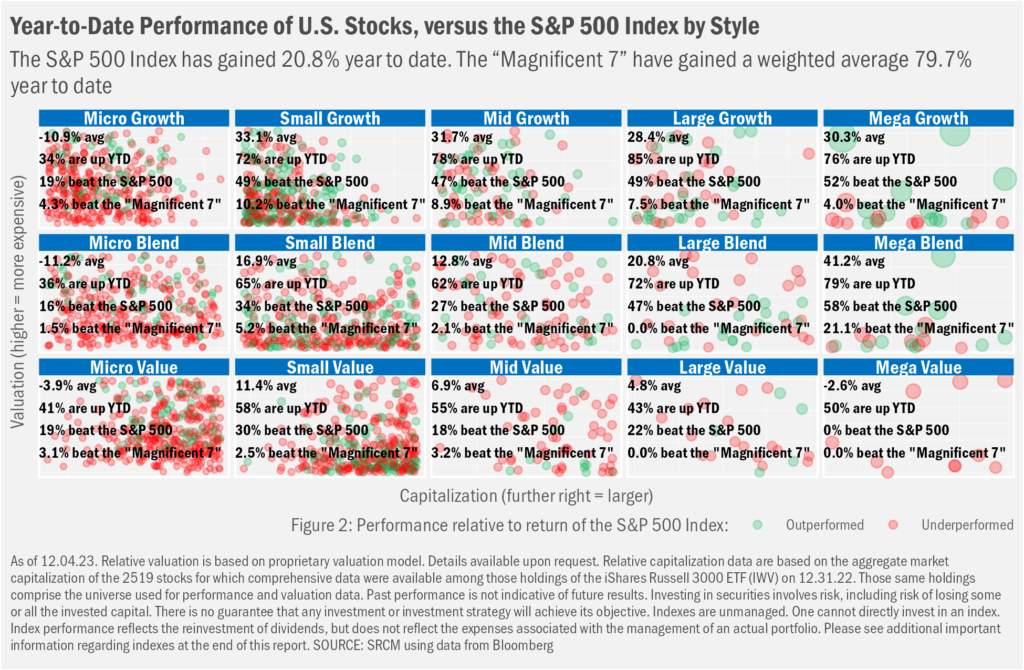

Despite the heavy attention paid to the Mag7, though, their outsized contributions were just parts of a broader trend of outperformance by Growth stocks. Divvying the market by two features—size (market capitalization) and valuation—in Figure 2 we can see the strong concentration of returns among larger and more expensive names. But there’s plenty of green across much of the Growth stock group. Growth stocks are deemed so for the relatively rich valuations investors assign their shares, presumably due to their higher future growth prospects. This excitement is understandable, as it’s often supported by concurrent levels of exceptional growth. But because the price of a stock is understood to be the present value of future cash flows, the higher the price relative to current cash flows, the more of that potental future is already incorporated into the stock price. History suggests, however, that the expected growth that underlies the more expensive valuations of Growth stocks tends not to materialize in the manner that Growth investors originally envision, such that going-forward returns tend to prove more muted, sometimes even as near-term growth remains seemingly robust.

Ms. Jackson Asks…

Call it the, “what have you done for me lately?” syndrome of Growth-stock investing. A fine example of how this works surfaced when arguably the most high-flying, attention-grabbing name among the Magnificent 7 reported its latest quarterly earnings in November. Despite turning in 12-fold earnings growth year-on-year against a tripling in quarterly revenue to more than $18 billion, shares in chipmaker Nvidia drifted lower immediately after the report and further still in more recent days, even as the broader market moved higher: since the November 21 post-close report, NVDA shares are off nearly 9%, while the S&P 500 Index has gained 0.8%.

Why the rather grim reception? Simply stated, we figure the “growth” aspects of the stock price reflect the notion that such outstanding relative performance is already baked into the pie. For investors to retain their enthusiasm, Nvidia likely will have to continue to exceed expectations. And by that we mean not just publicized Wall Street analyst “consensus” expectations, but the potentially even loftier “whisper” expectations that such growthy stocks tend to foster.

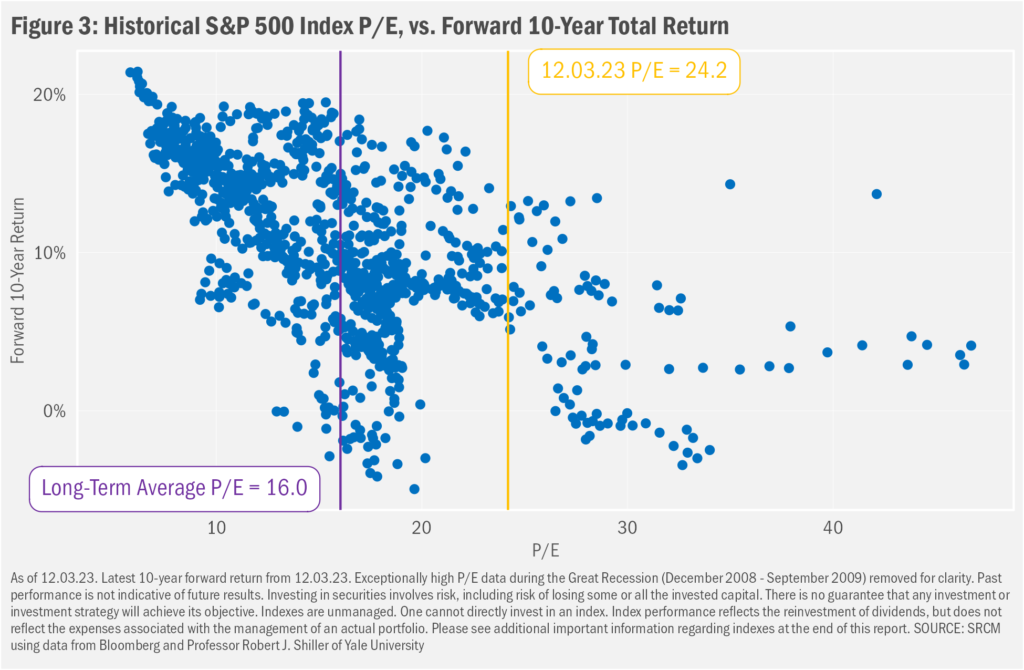

We’re actually fans of Nvidia and its products (not that such opinions have any place in our investment approach) and even share the belief that future medium-term growth might remain stellar for the company. However, history still suggests investors eventually will find disappointment in Nvidia’s future fundamental performance (revenue and earnings gains), with corresponding lackluster relative stock performance arising as a result. That’s just been the nature of the historical relationship between stock valuation and subsequent performance both for individual stocks and for the market as a whole. Shown in Figure 3 are data that compare valuation to future performance of the S&P 500. Clear in those data is a tendency for higher future return to follow less-expensive starting valuations and vice versa. It’s quite a rudimentary view, but the simplicity and clarity of the data remain foundational to the core of our investment approach.

As we close out 2023, wishing all a safe and festive holiday season and a grand launch into the New Year!

Important Information

Signature Resources Capital Management, LLC (SRCM) is a Registered Investment Advisor. Registration of an investment adviser does not imply any specific level of skill or training. The information contained herein has been prepared solely for informational purposes. It is not intended as and should not be used to provide investment advice and is not an offer to buy or sell any security or to participate in any trading strategy. Any decision to utilize the services described herein should be made after reviewing such definitive investment management agreement and SRCM’s Form ADV Part 2A and 2Bs and conducting such due diligence as the client deems necessary and consulting the client’s own legal, accounting and tax advisors in order to make an independent determination of the suitability and consequences of SRCM services. Any portfolio with SRCM involves significant risk, including a complete loss of capital. The applicable definitive investment management agreement and Form ADV Part 2 contains a more thorough discussion of risk and conflict, which should be carefully reviewed prior to making any investment decision. All data presented herein is unaudited, subject to revision by SRCM, and is provided solely as a guide to current expectations.

The S&P 500 Index measures the performance of the large-cap segment of the U.S. equity market.

The opinions expressed herein are those of SRCM as of the date of writing and are subject to change. The material is based on SRCM proprietary research and analysis of global markets and investing. The information and/or analysis contained in this material have been compiled, or arrived at, from sources believed to be reliable; however, SRCM does not make any representation as to their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated thereby. Any market exposures referenced may or may not be represented in portfolios of clients of SRCM or its affiliates, and do not represent all securities purchased, sold or recommended for client accounts. The reader should not assume that any investments in market exposures identified or described were or will be profitable. The information in this material may contain projections or other forward-looking statements regarding future events, targets or expectations, and are current as of the date indicated. There is no assurance that such events or targets will be achieved. Thus, potential outcomes may be significantly different. This material is not intended as and should not be used to provide investment advice and is not an offer to sell a security or a solicitation or an offer, or a recommendation, to buy a security. Investors should consult with an advisor to determine the appropriate investment vehicle.