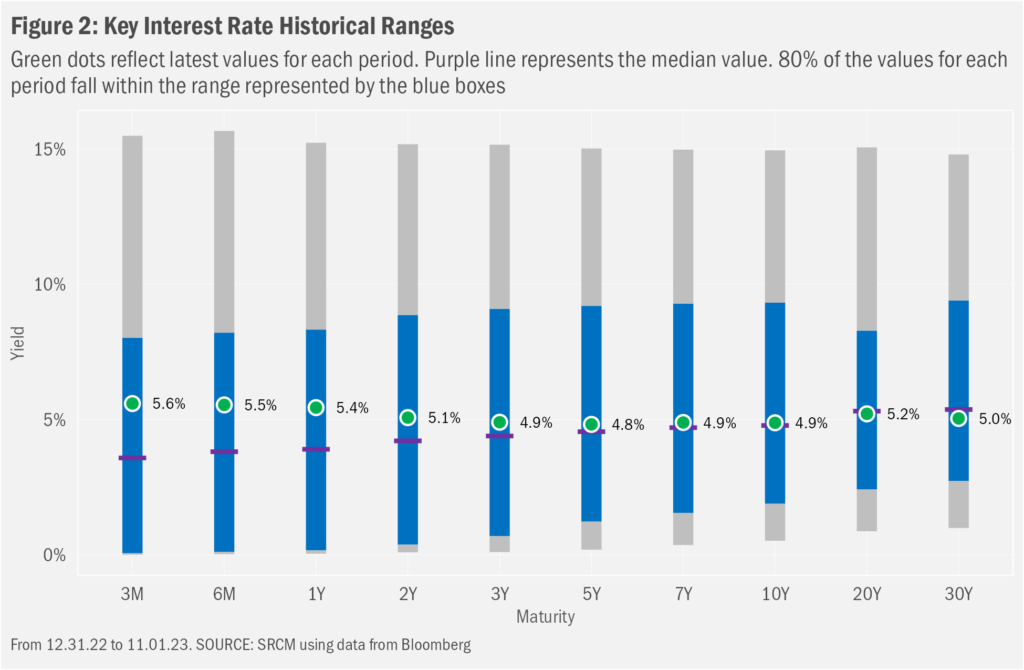

Those investors pulled toward short-term Treasuries for their multi-decade peaks may wish to look beyond near-term highs at the front end of the yield curve to ensure they have a plan for those funds when maturities arrive. Such generous yields might not then be on offer. That “reinvestment risk” might mean that longer-term bonds may be a better fit for purpose in some situations, despite somewhat lower current yields and likely higher price volatility to maturity:

- A guaranteed 1-year 5.4% return is a tempting draw. What about 5.0% each year for the next 2, 20 or 30 years?

- Folks with higher aversion to risk, longer-term time horizons and no interim need for associated funds may wish to consider Treasury securities maturing well in the future, despite their comparatively lower yields

- Of course, those longer-term yields may only be realized when the bonds are held to maturity. And longer-term bond prices are likely to remain volatile on account of likely ongoing heightened volatility in interest rates

- Care thus should be taken to match any longer-duration holdings with the time horizons associated with specific expected uses for the invested funds once the bond(s) mature

Perhaps More Fitting…

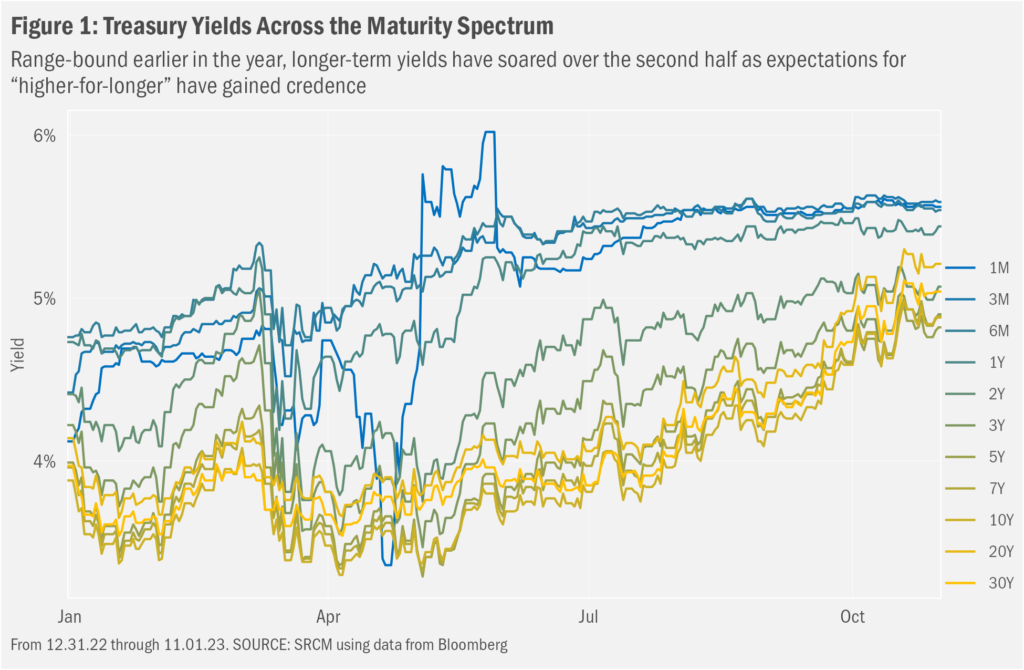

After having been repressed for so long by monetary policy intended to offset a range of macroeconomic phenomena (the Great Recession, COVID-19 pandemic and others), interest rates began to advance in mid-2021 as investors foresaw central banks easing off their highly accommodative stances. Rates rose further through 2022 as monetary policy makers more aggressively sought to combat persistent inflation. Earlier this year, though, a question rose to top-of-mind for investors: would the shift higher prove short- or long-term? For much of this year, investors seemed to have projected a sense that no regime change was in the offing: that central banks would have to turn coat and resort to rate cuts to bolster the economy in the face of a recession spawned by their work to control inflation. By early summer, however, that stance had shifted, presumably on account of still-robust macroeconomic activity amidst taming inflation. As we show in Figure 1, longer-term rates have soared as a result.

…In the Long Run

That surge will have proved costly for owners of bonds with longer maturities, at least in terms of their unrealized losses. Even so, the potential for such nearer-term losses may have been understood and accepted when investors purchased those bonds. As we have discussed in other recent commentaries and podcasts, investors have many reasons for owning bonds of specific maturities. In the case of longer-maturity bonds, investors may have been content to secure the assurance of a guaranteed “held-to-maturity” total return (income plus capital gain/loss), despite the potential for “marked-to-market” interim losses over the remaining life of the bond.

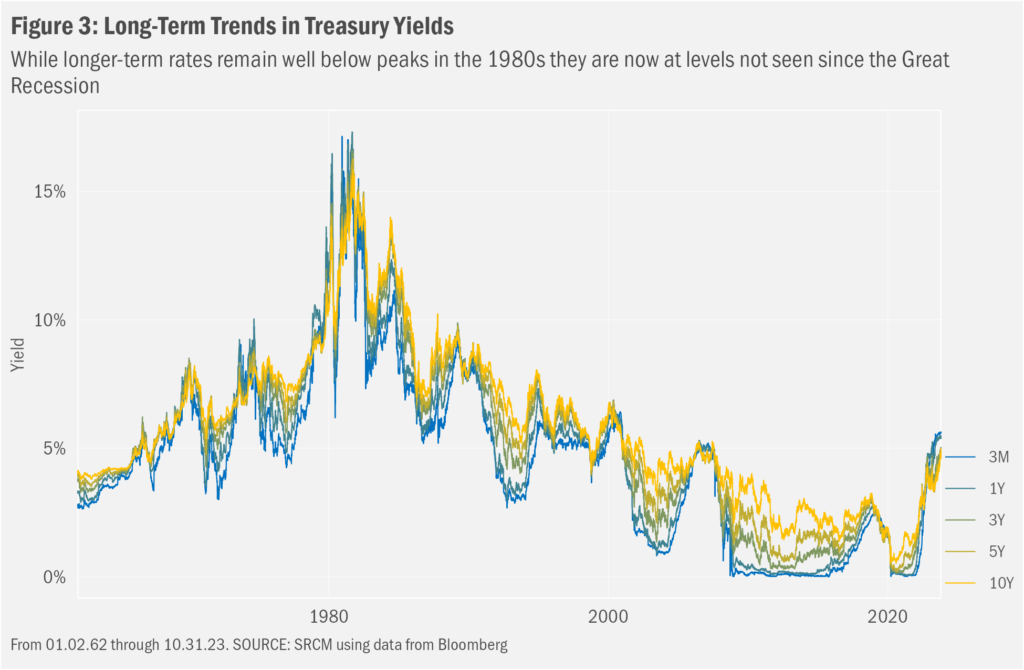

Similarly, now that yields on offer are vastly more generous across the curve, investors that might otherwise had retained a focus on short-term yields may find that longer-term yields are sufficient for specific goals. And, generally speaking, one should want to choose greater confidence in a particular expected return (e.g., yield to maturity on a Treasury) over the potential for even larger upside (e.g., unknowable long-term performance of stocks), where the surer return seems to meet intended goals. That thinking is furthered by the notion that, given the magnitude of the recent surge in rates and the level of present rates in a longer historical context, one might conclude that the outlook for rates over the medium term (i.e., the lifetime of much of the bonds space in question) may be more balanced. Even more, now that rates are higher, any subsequent increases in rates of similar magnitude may have less of a negative effect on total returns, given the now far more plush cushion the increased income provides.

Even so, rates are likely to remain volatile as investors digest macroeconomic trends as they evolve. Key to the magnitude of that volatility likely will prove ongoing progress against inflation (Will inflation continue to decline, or might we see a resurgence?) within the context of the future pace of change in the global economy (Will tighter monetary policy succeed in taming inflation without inciting a recession?). Investors there still may wish to review how comfortable they might be with the possibility of further large shifts in bond prices, even as they might welcome higher yields over a longer time horizon from their fixed income holdings.

Important Information

Signature Resources Capital Management, LLC (SRCM) is a Registered Investment Advisor. Registration of an investment adviser does not imply any specific level of skill or training. The information contained herein has been prepared solely for informational purposes. It is not intended as and should not be used to provide investment advice and is not an offer to buy or sell any security or to participate in any trading strategy. Any decision to utilize the services described herein should be made after reviewing such definitive investment management agreement and SRCM’s Form ADV Part 2A and 2Bs and conducting such due diligence as the client deems necessary and consulting the client’s own legal, accounting and tax advisors in order to make an independent determination of the suitability and consequences of SRCM services. Any portfolio with SRCM involves significant risk, including a complete loss of capital. The applicable definitive investment management agreement and Form ADV Part 2 contains a more thorough discussion of risk and conflict, which should be carefully reviewed prior to making any investment decision. All data presented herein is unaudited, subject to revision by SRCM, and is provided solely as a guide to current expectations.

The opinions expressed herein are those of SRCM as of the date of writing and are subject to change. The material is based on SRCM proprietary research and analysis of global markets and investing. The information and/or analysis contained in this material have been compiled, or arrived at, from sources believed to be reliable; however, SRCM does not make any representation as to their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated thereby. Any market exposures referenced may or may not be represented in portfolios of clients of SRCM or its affiliates, and do not represent all securities purchased, sold or recommended for client accounts. The reader should not assume that any investments in market exposures identified or described were or will be profitable. The information in this material may contain projections or other forward-looking statements regarding future events, targets or expectations, and are current as of the date indicated. There is no assurance that such events or targets will be achieved. Thus, potential outcomes may be significantly different. This material is not intended as and should not be used to provide investment advice and is not an offer to sell a security or a solicitation or an offer, or a recommendation, to buy a security. Investors should consult with an advisor to determine the appropriate investment vehicle.