While it’s understandable that investors may get excited about future prospects of new industries and business models, that enthusiasm may need to be tempered when it comes to the associated investment cases. Early investors may see substantial gains from the immense risks they took on when potentially grand success was merely imagined. But even later buyers-in may be arriving when measurably optimistic prospects are still baked into the valuation pie. Past examples of the resulting heartburn may provide reason for caution:

- Market history is strewn with examples of investors rallying around emergent business themes, only to find their return expectations to have proved wildly optimistic. Disappointing outcomes may be especially acute when investments are concentrated across relatively few participants in the new models

- Perhaps better to spread investments across a wider range of potential future winners from yet unforeseen advantages than buy into an already widely priced-in story

- Though it may seem painful in the short-term to have not fully participated in hyperbolic gains, more rationale perspectives may lead to improved longer-term outcomes

Listen to this month's Notes from the CIO podcast:

Podcast: Play in new window

Subscribe: Apple Podcasts | RSS

So Top Heavy

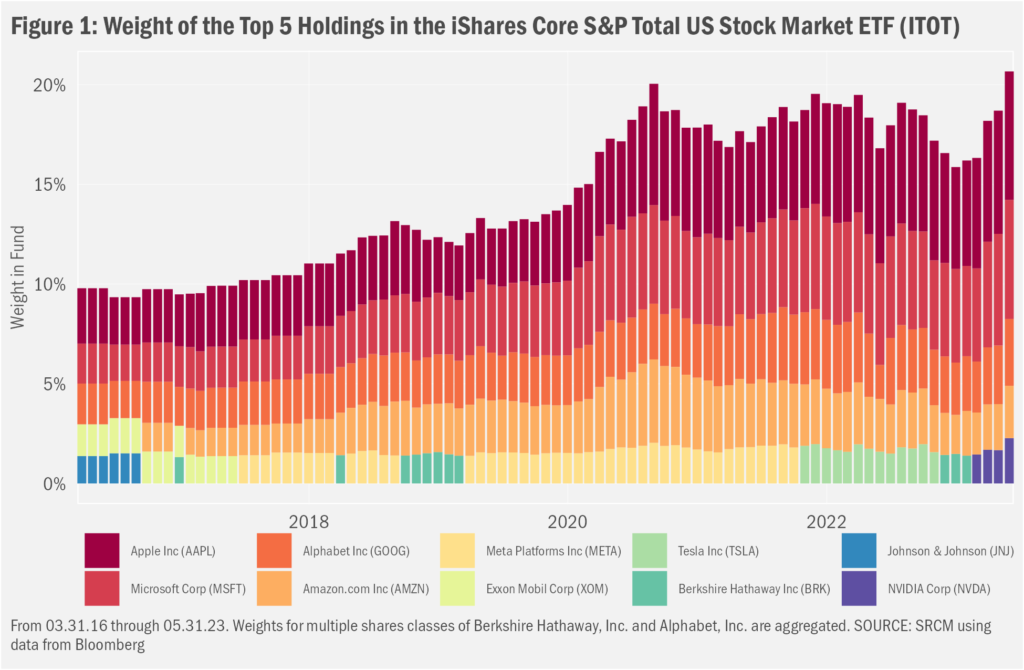

One can argue that the outsized gains experienced by its largest stocks over the past few years have seen the domestic equity market become a good bit less diversified. Rising from near a tenth of the U.S. market in early 2016, the five biggest names in terms of market capitalization now account for more than 20% of the broadest market exposure and represent an even higher concentration when one looks at large-cap stocks alone. Definitionally, that heavier concentration may have allowed some investors to benefit from the gains that have led to that declining diversity. One naturally wonders, though, to what undue risks might the ongoing ownership of these now far weightier names expose investors. As with most things in investing, the answer must be a nuanced one. From our perspective, the ongoing risks are less about the size than they are about how that size has come about. Most meaningful: what happens if the optimistic investment themes that have been driving some of what we see as excess returns fail to meet expectations?

Imagine an Ill Wind…

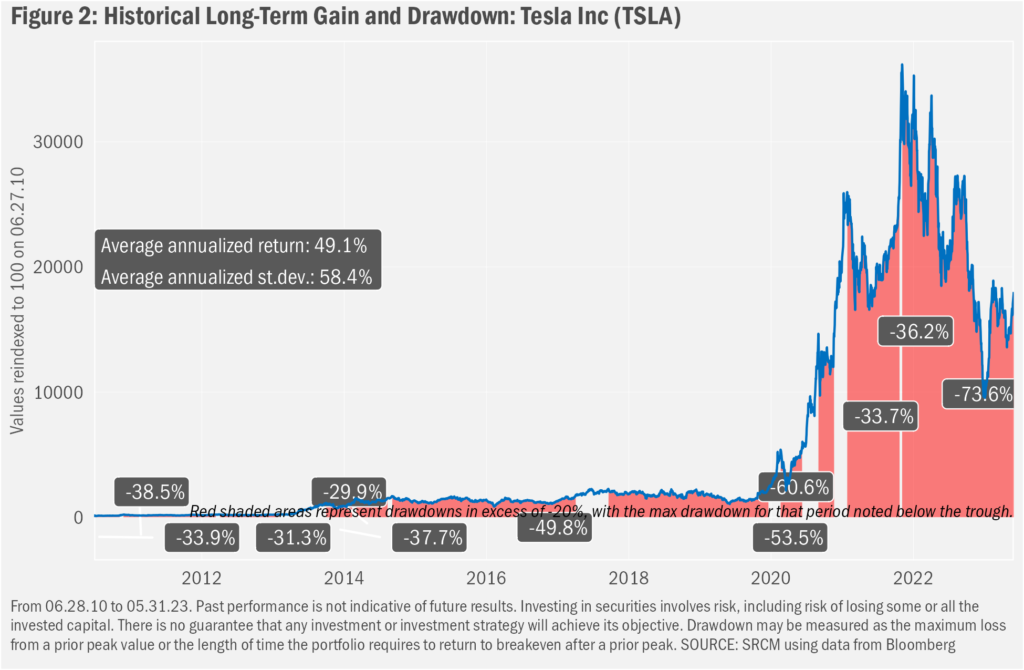

Given the expectations reflected in the current valuations of these large-cap, mostly technology-oriented names, we don’t doubt that investors in any one or all of the current Big-5 U.S. stocks could experience future disappointment. Such are the natures of corporate, industry and macroeconomic cycles. One need only review the jostling about for fifth position on that top-5 list to find a fine example of the consequences of a failure to achieve growth-oriented goals implied by a soaring stock price and accompanying valuations. Then arguably reflecting a “they’ll own the whole car market!” narrative, Tesla (TSLA) shares traded near $410 in November 2021. Investors who piled in on the way from $200 to $400—now that the stock made a round trip from that prior peak—may have learned the lesson that high multiples require lofty goals to be met for the stock just to stay still. Further gains require even loftier goals be set and eventually achieved. When fractures in the growth story multiply, however, valuations tend to do the opposite. Though the shares are close to double their beginning-of-year lows, the TSLA story still suffers from concerns regarding pricing pressures amidst growing competition and slowing growth.

As we show in Figure 2, long-term TSLA investors should not have found recent volatility surprising. Similarly, the most recent entrant into the Big 5 list, Nvidia Corporation (NVDA), is no stranger to wild swings in relative performance. While shares in the chipmaker have soared 250% from a more recent trough in October of last year, it was less than a year ago when the stock had fallen by two thirds from a post-pandemic peak, far exceeding the decline in the broader stock market. That run was sparked by beliefs that cryptocurrency mining and various other server- and gaming-related trends would push chip sales to the moon. Reality set in and investors saw fit to establish a more rationale perspective on the company’s prospects for growth.

Despite that lesson, here we go again, only this time with more feeling! Nvidia is now the poster child of the artificial intelligence (AI) craze that’s presumably behind the tech-stock outperformance highlighted earlier, having positioned itself as the premier source of chips specialized to serve as the hardware-based “brains” for AI. And for the software side of AI, Microsoft has begun to incorporate across its product lines technologies to which it gained access via investment in arguably the most notable player in the AI technology space, OpenAI. Microsoft also is pitching itself as a provider of the incremental computing power required to utilize AI tech. MSFT shares are up just under 40% year to date, versus the broader market’s 11-ish percent rise.

…Or a Storm of Reason

As Nvidia and Microsoft shares gain ground on the hopes for AI’s eventual hegemony and their roles in that conquest, neither their individual successes, nor the short- to long-term prospects for profits related to AI are in any manner certain by magnitude or even fact. More experienced investors may recall similar enthusiasm for the Internet in its very early days. Though we find the extent of the diversion from sane valuations very different for those two stocks and not near as dramatic as many examples from the Technology Bubble of 2000, we do find in current market dynamics similarities to those that took hold in the surge up to the Bubble’s bursting.

What came after the burst may be interesting to those wondering what to make of the current market environment. From late 2000 through 2003, while the broader market suffered a long hangover due to earlier excesses, Value stocks and small-cap stocks had a historic go of it, having been left behind the earlier tech-focused surge. As even more time passed, shares of many of the higher fliers that managed to stay aloft became relatively attractive from a valuation standpoint as investors remained skeptical even as earlier growth stories proved at least somewhat true. Indeed, shares in all the current Big 5 but Amazon have spent time over the past twenty years showing valuations approximate to or less expensive than the broader market. That fact suggests valuation- and quality-sensitive investors may well have found them worthy of emphasis within portfolios.

Experience from those days further indicates to us today’s heavily concentrated passive investment landscape presents a scene of opportunity. It’s perhaps both too late and too early for AI investments: too late as the initial rush already is well underway; too early as the potential capacity to deliver profit via the application of still-evolving AI technologies is yet mostly unknown. Indeed, if the history of the Internet is any guide, a wide set of companies across the investment landscape may see profit-enhancing benefits from AI, not just the “picks and shovels” providers like Microsoft and Nvidia.

Important Information

Signature Resources Capital Management, LLC (SRCM) is a Registered Investment Advisor. Registration of an investment adviser does not imply any specific level of skill or training. The information contained herein has been prepared solely for informational purposes. It is not intended as and should not be used to provide investment advice and is not an offer to buy or sell any security or to participate in any trading strategy. Any decision to utilize the services described herein should be made after reviewing such definitive investment management agreement and SRCM’s Form ADV Part 2A and 2Bs and conducting such due diligence as the client deems necessary and consulting the client’s own legal, accounting and tax advisors in order to make an independent determination of the suitability and consequences of SRCM services. Any portfolio with SRCM involves significant risk, including a complete loss of capital. The applicable definitive investment management agreement and Form ADV Part 2 contains a more thorough discussion of risk and conflict, which should be carefully reviewed prior to making any investment decision. All data presented herein is unaudited, subject to revision by SRCM, and is provided solely as a guide to current expectations.

The opinions expressed herein are those of SRCM as of the date of writing and are subject to change. The material is based on SRCM proprietary research and analysis of global markets and investing. The information and/or analysis contained in this material have been compiled, or arrived at, from sources believed to be reliable; however, SRCM does not make any representation as to their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated thereby. Any market exposures referenced may or may not be represented in portfolios of clients of SRCM or its affiliates, and do not represent all securities purchased, sold or recommended for client accounts. The reader should not assume that any investments in market exposures identified or described were or will be profitable. The information in this material may contain projections or other forward-looking statements regarding future events, targets or expectations, and are current as of the date indicated. There is no assurance that such events or targets will be achieved. Thus, potential outcomes may be significantly different. This material is not intended as and should not be used to provide investment advice and is not an offer to sell a security or a solicitation or an offer, or a recommendation, to buy a security. Investors should consult with an advisor to determine the appropriate investment vehicle.