It’s not rare that we sit scratching our heads at obvious contradictions expressed by investment markets. But that generally is not because obviously opposing opinions are surprising. After all, any individual trade requires that the buyer and seller have opposite opinions on whether to hold a particular security. That’s not a paradox…it’s a market. But current circumstances present a few differences of opinion well worth a review:

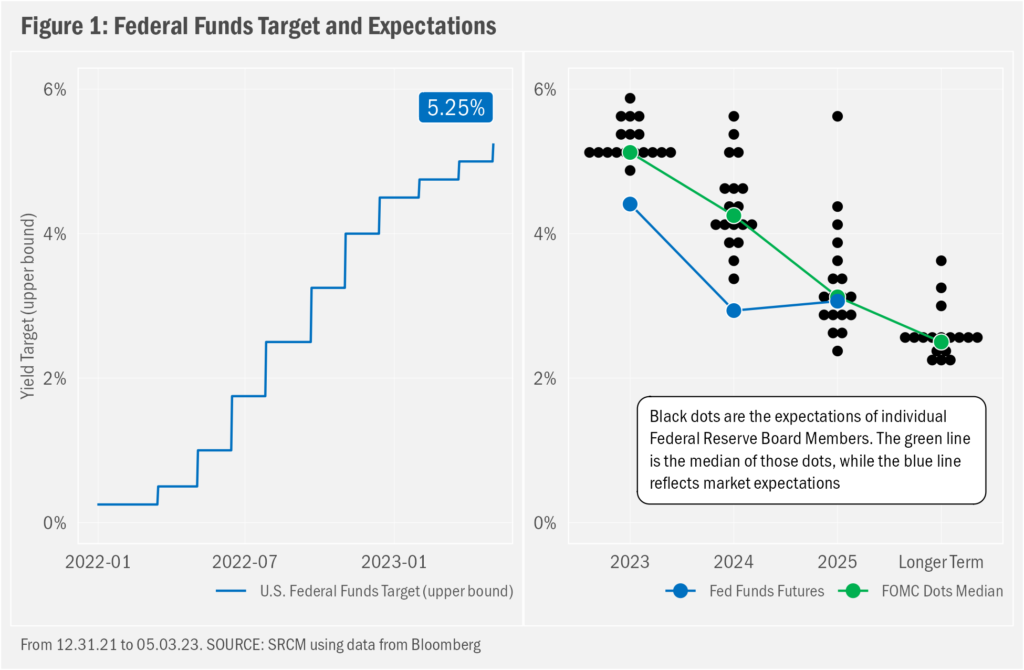

- While the Federal Reserve continues to believe that it will maintain interest rates “higher for longer” in light of falling, but still persistent inflation, bond markets expect the Fed to begin cutting rates as early as this summer

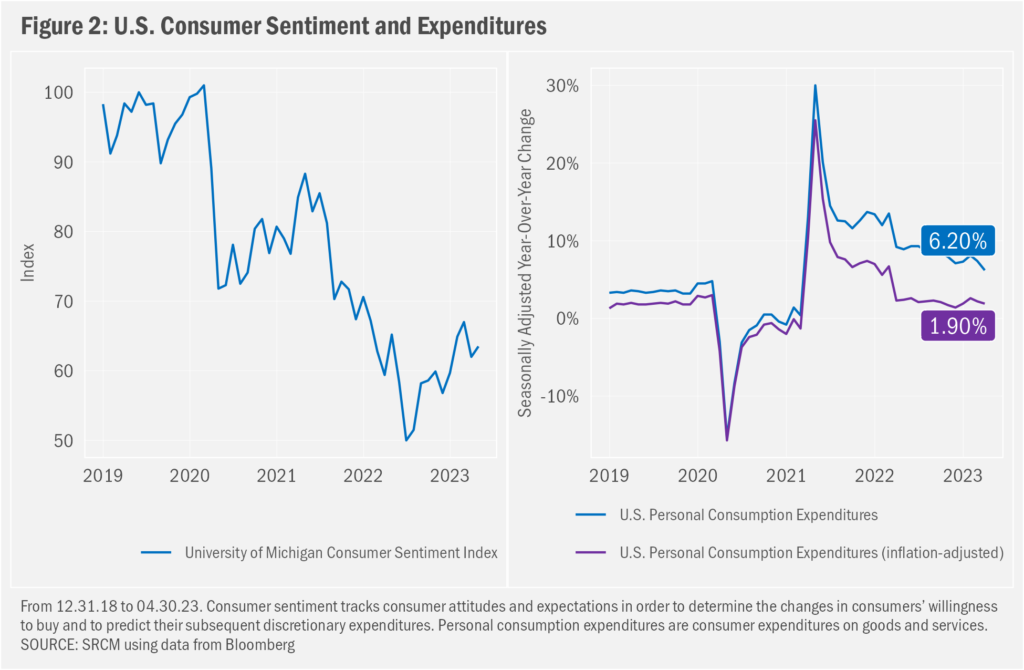

- Sentiment indexes suggest U.S. consumers are as pessimistic as they’ve been since early 2022, and yet consumer spending remains relatively robust

- The Fed may have to be wrong in its expectations, unemployment may need to surge and consumers likely will need to have zipped up their wallets if the bond market’s belief that a recession is in store is to come true

- A long-term-oriented investor can be braced for the near term, yet optimistic for the future and find no contradiction in those views

Mixed Messages

This morning, the Federal Reserve Board announced another hike in its target for overnight lending, resulting in a range of 5.00% to 5.25%. As suggested by the Board members’ individual expectations, this may prove the final hike of this cycle. Investors seem to agree. Where the Board and investors differ is when the cuts will begin. As we show in Figure 1, investors believe the target rate will be substantially lower by the end of this year, while most Board members believe we won’t see cuts until next year. Investors are even more aggressive in their expectations for cuts through year-end 2024. The two buckets of expectations meet only in 2025, when the fed funds rate is expected to begin approaching the Fed’s longer-term target of 2.5%. Arguably driving these gaps are differing estimations as to the effectiveness of monetary policy in fighting inflation: the Fed continues to believe that its efforts to tame inflation will prove successful without seeing great detriment to macroeconomic momentum; investors seem to think a recession is soon in store.

The Federal Reserve releases its expectations only quarterly, the last being provided on 03.22.2023. We won’t see a revised set of projections until next month. But market expectations are real time. The fact that macroeconomic data have evolved since the dots were released can explain some manner of the observed gap.

But the mismatch likely includes a component related to Federal Reserve signaling. A good portion of the power of monetary policy comes from guidance provided by Board members. Like most things in finance and investment, what’s done is done; what’s matterful is what will happen next. The Federal Reserve is telling us that it remains committed to taming inflation, to some extent regardless the near-term effects on the broader economy, including employment. The Fed’s insistence has helped keep a lid on market expectations for inflation. And those expectations suggest, again, that investors believe that the Fed will succeed in taming inflation, just not without a recession.

Spending Despite

Speaking of signaling, consumers continue to express fear and doubt about the economy, with sentiment only modestly above lows set last year. But those data are showing improvements, nonetheless. Addressing April data from the survey, Univ. of Michigan’s Surveys of Consumers Director Joanne Hsu noted, “Consumer sentiment was little changed this month, inching up less than two index points from March. Buying conditions for durables improved 11% primarily on the basis of easing perceptions of unaffordability. Despite the increasingly negative news on business conditions heard by consumers, their short- and long-run economic outlook improved modestly from last month. These improvements were balanced by worsening assessments of personal finances due to higher expenses, reflecting the ongoing pain stemming from continued high prices.”

Despite still being more than a bit on the unhappy side of the spectrum, consumers continue to spend. While January data were good on this front, February and March offered mixed messages. But for the time being, at least, spending growth remains positive, providing a critical prop for growth.

Watching the Data

Key to the future path of rates will be shifts in macroeconomic trends, with inflation being the most relevant. We’ve lately seen further progress on that front, though the specifics are divergent. Prices across a broad list of commodities have continued to fall, with oil more than 40% below its March 2022 peak. While “shelter” inflation remains high, expectations (given how the math works) are for declines later this year. And very recent data suggest labor-market inflation could be easing, both in terms of actual upward movement in prices and in terms of the drivers of upward pressures (demand for labor).

Availability of credit for small- and medium-sized businesses will also be a focus of the data. Dampening credit availability and usage is a primary objective of policy tightening. But the strains across the banking space may have been adding to and may continue to add further pressure on bank lending, while also boosting volatility in lending trends. The latter may make it more difficult to discern more durable shifts in the data.

But, again, inflation will remain the primary focus. During the press conference today, Chairman Powell noted that the Board expects inflation to come down “not so quickly”, such that maintaining its current rather restrictive stance will be required. But the Federal Reserve still believes an outcome that does not involve a severe recession is likely.

We’ve still a way to go to get to the desired 2% inflation target, but recent data support the Fed’s thinking. Macroeconomic growth remains positive: the first estimate of first-quarter GDP showed annualized growth of 1.1%, down from an annualized gain of 2.6% in the fourth quarter of 2022. That’s not great, but part of the sluggishness came as a result of an inventory drawdown. After a period of too much stock on hand, manufacturers, distributors and retailers held off on restocking (which also had the effect of supporting prices). Now that inventories have declined, any rebuild in those inventories amidst even static demand may support going-forward growth.

Caution Warranted. As Always

The path of the broader economy over the next several quarters remains as uncertain as ever. But, given the circumstance, the present lack of clarity seems not so out of the ordinary. The major events of the past several decades—the bursting of the Technology Bubble, the Great Recession, the European Debt Crisis, the COVID Pandemic—have offered regular reminders that markets are volatile, but that they tend to recover with time after major drawdowns.

With global stocks still down nearly 13% from their January 2022 peak, the market can be seen as suggesting the worst might have passed, but that we are not yet out of the woods. Similarly, an investor can be fearful in the near term, yet optimistic for the long term and see no contradiction in those views. Given the give/take nature of risk/return, it’s actually a more natural state of mind, we think.

Important Information

Signature Resources Capital Management, LLC (SRCM) is a Registered Investment Advisor. Registration of an investment adviser does not imply any specific level of skill or training. The information contained herein has been prepared solely for informational purposes. It is not intended as and should not be used to provide investment advice and is not an offer to buy or sell any security or to participate in any trading strategy. Any decision to utilize the services described herein should be made after reviewing such definitive investment management agreement and SRCM’s Form ADV Part 2A and 2Bs and conducting such due diligence as the client deems necessary and consulting the client’s own legal, accounting and tax advisors in order to make an independent determination of the suitability and consequences of SRCM services. Any portfolio with SRCM involves significant risk, including a complete loss of capital. The applicable definitive investment management agreement and Form ADV Part 2 contains a more thorough discussion of risk and conflict, which should be carefully reviewed prior to making any investment decision. All data presented herein is unaudited, subject to revision by SRCM, and is provided solely as a guide to current expectations.

The opinions expressed herein are those of SRCM as of the date of writing and are subject to change. The material is based on SRCM proprietary research and analysis of global markets and investing. The information and/or analysis contained in this material have been compiled, or arrived at, from sources believed to be reliable; however, SRCM does not make any representation as to their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated thereby. Any market exposures referenced may or may not be represented in portfolios of clients of SRCM or its affiliates, and do not represent all securities purchased, sold or recommended for client accounts. The reader should not assume that any investments in market exposures identified or described were or will be profitable. The information in this material may contain projections or other forward-looking statements regarding future events, targets or expectations, and are current as of the date indicated. There is no assurance that such events or targets will be achieved. Thus, potential outcomes may be significantly different. This material is not intended as and should not be used to provide investment advice and is not an offer to sell a security or a solicitation or an offer, or a recommendation, to buy a security. Investors should consult with an advisor to determine the appropriate investment vehicle.