In common parlance, to discount a statement means to not take the assertion at face value. In finance, to “discount” something means to develop a current value for a potential investment by estimating a future value and any cash flows in between. The market has been roiling with evolving themes and variations on both notions:

- For months now, investors have been forced to quantify boldly unconventional macroeconomic statements and projections of presidential programs, with tariff policies still top-of-chart in terms of market impact

- This process of double discounting—quantifying the potential impact of a statement after one quantifies the likelihood that the statement will prove accurate—can be said to have resulted in wild swings in market mood

- Much as always in the case, we believe investors should continue to weigh tolerance for increased market volatility against short- and long-term financial plans (read: try not to make hasty decisions)

- Even so, we continue to believe that potential disruptions not unfamiliar in recent times may warrant heightened caution when reviewing potential shifts in exposures to investment risk and in determining the timing of any required distributions

Mincing Words

It’s one thing for investors to gauge potential policies of an incoming presidential administration in advance of specific pronouncements. And it’s another to estimate the impact of a particular policy or group of policies once announced. It has been far rarer in history that investors have been forced to evaluate what portion of a policy statement is indicative of direction of intent, versus actual intention, to the extent as has been the case with the current administration. With this administration, efforts to parse the directional from the definitive range from parlor game dartboarding to the serious work of capital planning and investment. Those in the latter camp seemingly have been thrown for many loops, judging by year-to-date market activity. Of particular note has been the expansion in intraday returns (charted in Figure 1); on April 9 the SPDR S&P 500 ETF Trust (SPY), which is designed to track the performance of the large-cap-focused S&P 500 Index, saw an 11.3% difference between its low and high price on April 9, the seventh widest in that fund’s history, which goes back to the beginning of 1993. That was the broadest gap since May 6, 2010, which was exceeded only by wild swings during October and November 2008 during the depths of the Great Financial Crisis. The largest intraday span was 12.7% on October 13, 2008. April 9 was the day that the president midday announced a 90-day pause on the round-the-world tariffs declared a week prior. The earlier “Liberation Day” announcement precipitated a 12% plunge in domestic shares that had brought the U.S. market within a hair of a bear before the pause pulled investors back into equities.

In early February 2024 during presidential election campaigns, press reports suggested President Trump might assess a 60% tariff on all goods coming in from China. When asked about the rumor, President Trump stated that the rate might be more than that. We recall at the time that it seemed most folks (admittedly ourselves included) figured even 60% so impossibly high that the statement was meant to be more “indicative of direction” than “actual level of intent”. Post election, however, tariffs variously levied on Chinese goods have ramped to a maximum 145%, with the first shipments of goods to which those rates will apply hitting U.S. shores this month. As for the rest of the world, President Trump had mooted at 10- to 20-percent across-the-board tariffs during the campaign. So, the actual implementation of 10 percent everywhere might not have been a surprise, were it not for the much higher-than-expected country-specific tariffs the administration announced on Liberation Day.

Markets are “Wrong”?

Investors were clearly surprised by the breadth and intensity of the tariffs. The dramatic selloff is the most suggestive fact of such. But what are folks thinking now? We’ll admit to not having done much math in this context as 1) it would be a lot of work to do only to have events evolve into an outcome altogether different than one had devised and 2) a host of organizations offer very reasonable takes. Hard to know what portion of global investors has done such math, but we’d guess it to be vanishingly few for similar reasons. But we do have a sense of global investor expectations, which we read as still suggesting that the actual tariff regime is set to come in much less onerous than the one presently implied by the administration’s policy proposals. One might argue that the fact that the market has erased the Liberation Day plunge suggests investors are taking a much, much longer-term and substantially more positive view of the potential range of outcomes related to the going-forward evolution of tariff policies. One also could argue that there’s a very long road between now and the potential scenarios in which the current price is the right one if tariffs are implemented at levels even close to current plans. More likely, we think, the present error in bias may be that markets may be overly discounting the potential for the tariff regime to quickly arrive at a place ultimately only a bit more taxing than had been the case prior to this year (resolved more quickly and with modest meaningful difference from the pre-2025 regime). We hope that proves the case and still find such an outcome both possible and probable, but we aren’t holding our breaths.

Hopefully Negotiating Down

The potential for additional trade-related disruption, then, hinges primarily on the outcomes of trade-related negotiations, which only now are beginning in earnest. Progress may well prove halting, while interim declarations variously moving investment markets.

As we noted last month, we continue to agree with the broader consensus that the immediate effects of the tariff regime (as proposed) will be to put upward pressure on prices and dampen growth. The Federal Reserve highlighted this conundrum in remarks from its May meeting: “Uncertainty about the economic outlook has increased further. The Committee is attentive to the risks to both sides of its dual mandate and judges that the risks of higher unemployment and higher inflation have risen.”

We’ve heard many suggest that the Federal Reserve will be more likely to support growth in the face of further upward pressure on prices. But we’re not so sure. While we think that pressure from the president to cut rates in the face of growth will be ignored, such attempts at influence won’t ease the rate decision-making process. Even so, the current target isn’t that far from the Fed’s current group expectations for “neutral”, meaning at a level that supports its dual mandate of full employment and stable inflation and that is neither expansionary (supports growth), nor contractionary (restricts growth). Notably, Chair Powell stated during his May 7 press conference that, “[Federal Reserve] policy is sort of modestly or moderately restrictive.” So, there may not be much room to the downside for rates either way.

So long as macroeconomic strength takes a serious dive, that is. Just as Fed Chair Powell said will be the case, much ultimately will depend on the evolution of the data. The longer tariff negotiations take and the less favorable—meaning, ultimately, the higher—the aggregate level of tariffs ends up being, the worse for the near- and medium-term global macroeconomic backdrop: inflation likely will prove more durable and potentially will increase, while growth may sag, even decline. On the inflation front, tariffs will flow directly through to prices, regardless of the portion that gets paid by producers and consumers. Where the former pays, profits will suffer. For the latter, higher end-prices likely will result in lower consumption. In theory, tariffs might result in a one-time step up in prices. But depending on how various participants in the supply/demand chain react, higher inflation rates could prove more durable. Trade “frictions” are on the rise, and attention has turned to U.S. ports to gauge supply chain adaptation to the highly uncertain, but likely more burdensome tariff environment. Meantime, upward price pressures will be bolstered by the impact of the overall decline in and productivity of the immigrant workforce. And the expectations component of the inflation story will remain as important to investor views as will actual readings of realized inflation.

So, it’s by no means clear that inflation will continue to fall. Growth will be pressured by increased trade frictions—regardless the short-term outcomes, it would seem—while uncertainty with regard to the macroeconomic outlook is likely to dampen spirits otherwise inclined to pursue growth. Employment will likely suffer then, a trend worsened by cuts in government spending and employment.

There's a Dance Coming

We think the lessons of the late 70s/early 80s will remain at the fore, when the Fed was forced to resume rate increases in the face of stubborn inflation, despite sagging growth. Admittedly, inflation rates were in the teens back then, so the choice might ultimately have been a bit clearer, though that choice wasn’t obvious until it was. Where unemployment trends shift to the downside, however, Fed decisions will become far more greatly challenged. It’s therefore a good thing, as Chair Powell’s noted, that, “[Monetary policy is] 100 basis points less restrictive than it was last fall. And so, we think that leaves us in a good place to wait and see. We don't think we need to be in a hurry. We think we can be patient. We're going to be watching the data. The data may move quickly or slowly, but we do think we're in a good position where we are to let things evolve and become clearer in terms of what should be the monetary policy response.”

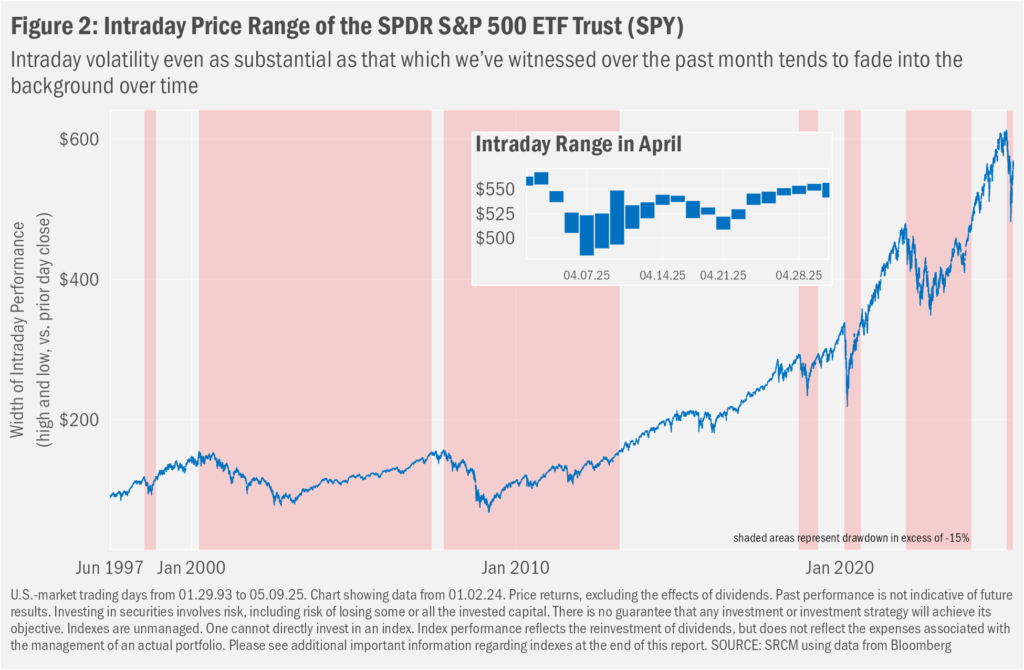

We think investors therefore should not be too confident that the worst of market tumult is behind us. Even so, market volatility, regardless of the source, is natural. And as we zoom out from daily throes—much as we have in Figure 2—we see that patience through such times of disruption ultimately has proved fruitful, at least prior to this latest drawdown. As always, we will invite readers to reach out to their advisors to discuss portfolio positioning and exposure to investment risk, with particular focus on any near-term needs for portfolio distributions.

Important Information

Signature Resources Capital Management, LLC (SRCM) is a Registered Investment Advisor. Registration of an investment adviser does not imply any specific level of skill or training. The information contained herein has been prepared solely for informational purposes. It is not intended as and should not be used to provide investment advice and is not an offer to buy or sell any security or to participate in any trading strategy. Any decision to utilize the services described herein should be made after reviewing such definitive investment management agreement and SRCM’s Form ADV Part 2A and 2Bs and conducting such due diligence as the client deems necessary and consulting the client’s own legal, accounting and tax advisors in order to make an independent determination of the suitability and consequences of SRCM services. Any portfolio with SRCM involves significant risk, including a complete loss of capital. The applicable definitive investment management agreement and Form ADV Part 2 contains a more thorough discussion of risk and conflict, which should be carefully reviewed prior to making any investment decision. All data presented herein is unaudited, subject to revision by SRCM, and is provided solely as a guide to current expectations.

The S&P 500 Index measures the performance of the large-cap segment of the U.S. equity market. The opinions expressed herein are those of SRCM as of the date of writing and are subject to change. The material is based on SRCM proprietary research and analysis of global markets and investing. The information and/or analysis contained in this material have been compiled, or arrived at, from sources believed to be reliable; however, SRCM does not make any representation as to their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated thereby. Any market exposures referenced may or may not be represented in portfolios of clients of SRCM or its affiliates, and do not represent all securities purchased, sold or recommended for client accounts. The reader should not assume that any investments in market exposures identified or described were or will be profitable. The information in this material may contain projections or other forward-looking statements regarding future events, targets or expectations, and are current as of the date indicated. There is no assurance that such events or targets will be achieved. Thus, potential outcomes may be significantly different. This material is not intended as and should not be used to provide investment advice and is not an offer to sell a security or a solicitation or an offer, or a recommendation, to buy a security. Investors should consult with an advisor to determine the appropriate investment vehicle.