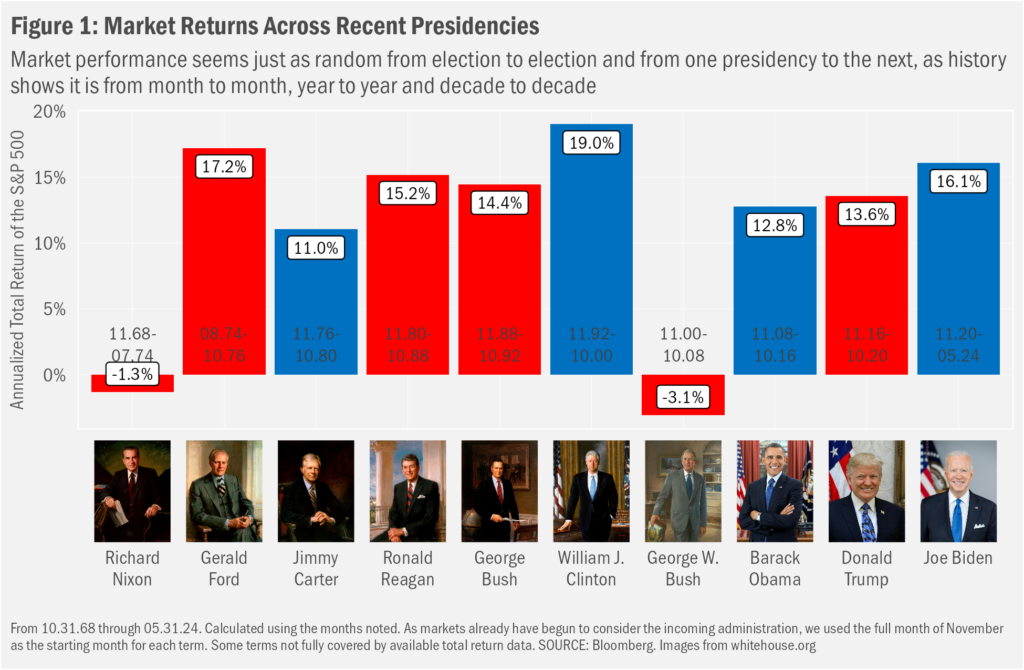

The are many questions regarding market expectations that we tend to find sufficiently addressed using historical data. “What’s your outlook for returns over the next x years?” generally gets a, “Well, historical x-year returns show a range of y% to z%, so likely something within that range.” The answer may not be satisfying, but it tends to be sufficient. We often have more difficulty fostering comfort with the idea that market outcomes seem to have ignored presidential political identities. Nonetheless:

- No matter the slice or dice, market returns seem independent of the White House resident

- Regardless the political persuasion, sitting out of the market during any particular president’s term(s) generally would have proved costly in terms of foregone gains

- Markets do not care what any individual, or even any large group of individuals, wants to see happen

- Neither does what one believes should have happened represent past performance

- We think it best to align exposure to investment risk with comfort to assume that risk in the context of longer-term market history, which…again…seems not to care who the U.S. president is

Knowable Risks

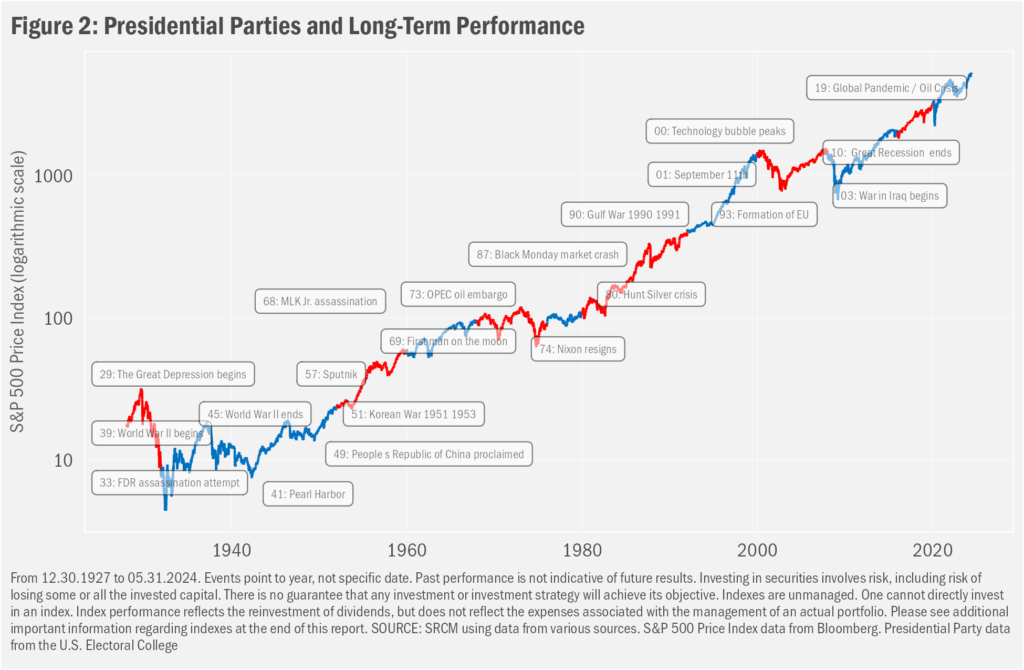

History suggests the domestic stock market seems broadly immune to the policies of any particular president or political party. It’s true that policies (e.g., changes in tax policy) may present short- and long-term market-supporting effects. But we tend to believe that shorter-term meaningful and durable deviations from average returns generally can be attributed to broader macroeconomic and/or geopolitical factors often well beyond the immediate control of the U.S. president. History therefore suggests in this context as well that, if we are to worry about anything, it’s the unexpected that should limit our enthusiasm for investment risk far more than should our opinions on the known policies of a sitting president or of those running for that seat.

Bigger Picture

Much as so many might like to believe otherwise, any individual president likely has played only a minor role in what has proved the historical long march upward in the domestic stock market. Indeed, if we had to point to major market inflections, one would be hard pressed to attribute the shift to the actions of an individual president. And even if we succeeded in defending such attribution on wonders if…at the time…one could have taken advantage of such forethought with a fruitful trade. With the S&P 500 Index sitting not far from its all-time peak, we are left with the conviction that ignoring the din related to the U.S. election cycles (Congressional, included) should prove a more fruitful path for most investors with reasonably long-term investment time horizons.

Important Information

Signature Resources Capital Management, LLC (SRCM) is a Registered Investment Advisor. Registration of an investment adviser does not imply any specific level of skill or training. The information contained herein has been prepared solely for informational purposes. It is not intended as and should not be used to provide investment advice and is not an offer to buy or sell any security or to participate in any trading strategy. Any decision to utilize the services described herein should be made after reviewing such definitive investment management agreement and SRCM’s Form ADV Part 2A and 2Bs and conducting such due diligence as the client deems necessary and consulting the client’s own legal, accounting and tax advisors in order to make an independent determination of the suitability and consequences of SRCM services. Any portfolio with SRCM involves significant risk, including a complete loss of capital. The applicable definitive investment management agreement and Form ADV Part 2 contains a more thorough discussion of risk and conflict, which should be carefully reviewed prior to making any investment decision. All data presented herein is unaudited, subject to revision by SRCM, and is provided solely as a guide to current expectations.

The S&P 500 Index measures the performance of the large-cap segment of the U.S. equity market.

The opinions expressed herein are those of SRCM as of the date of writing and are subject to change. The material is based on SRCM proprietary research and analysis of global markets and investing. The information and/or analysis contained in this material have been compiled, or arrived at, from sources believed to be reliable; however, SRCM does not make any representation as to their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated thereby. Any market exposures referenced may or may not be represented in portfolios of clients of SRCM or its affiliates, and do not represent all securities purchased, sold or recommended for client accounts. The reader should not assume that any investments in market exposures identified or described were or will be profitable. The information in this material may contain projections or other forward-looking statements regarding future events, targets or expectations, and are current as of the date indicated. There is no assurance that such events or targets will be achieved. Thus, potential outcomes may be significantly different. This material is not intended as and should not be used to provide investment advice and is not an offer to sell a security or a solicitation or an offer, or a recommendation, to buy a security. Investors should consult with an advisor to determine the appropriate investment vehicle.